Meet Our Donors

We are thankful for those who have made an estate gift to Southern Methodist University. Here are their stories.

Free Estate Planning Tool

Join fellow SMU supporters on Giving Docs, a safe, secure and free-for-life suite of estate plan essentials.

Get Started

A Gift with Great Returns!

Sometimes a gift can help the giver as well as the recipient. Ralph Shive, class of ’75, has established several charitable gift annuities to honor his favorite professor and support future students, receiving lifetime income and tax savings in return.

Read More

A Joyful Reunion

After meeting at a mixer at the SMU Baptist Student Union in the fall of 1968, sophomore Boyd Lyles and freshman Melanie Wright spent many dates cruising in Boyd's 1964 Ford Falcon and listening to popular rock bands on cassette tape.

Read More

Suzanne Schmidt, an SMU Story

A curious friend recently asked me, "How on earth did a girl with no money from a one-horse town in West Texas ever wind up at high-brow SMU?" Good question.

Read More

And the Poetry Continues...

The impact of beloved and renowned SMU English professor Laurence Perrine will continue thanks to a bequest made by his wife, Catherine. The couple met while teaching in SMU's English department.

Read More

I Had to Ask "Why"!

Why would a couple, each of whom holds two degrees from the University of Texas at Austin, decide to leave the bulk of their estate to SMU?

Read More

Scholarship Support Inspires Alum to Pay It Forward

If you ask anyone who met Zane Cavender while he was a student at SMU, they would probably tell you that his claim to fame isn’t the plethora of ways he was involved on campus, but rather his hilarious and spot-on impression of President R. Gerald Turner.

Read More

Creating a Legacy of Gratitude

As a high school student trying to make one of life’s biggest decisions, it can often be difficult to pinpoint exactly why one school feels more comfortable than another. For Diana Aguirre, she fell in love with SMU because it seamlessly combined a small, private school experience with the benefits and excitement of a large, technologically advanced city.

Read More

Grateful Mustang Makes a Difference

Southern Methodist University wasn’t originally in John Trahan’s plans, but one snowy visit changed his mind—and his life. After a 30-year career in banking, he’s hopeful his legacy gift to SMU will inspire future Mustangs in their own pursuits.

Read More

A Lifelong Love of Learning

As a student, Dr. William Jernigan '61 excelled. His academic prowess earned an SMU scholarship, sparking his lifelong commitment to academic excellence and Southern Methodist University.

Read More

Loyalty and Learning

Walt Henderson enjoyed attending SMU football games while growing up in nearby University Park. He remembers watching Mustang legends Doak Walker and Kyle Rote making history at SMU's Ownby Stadium, and then in the Cotton Bowl.

Read More

Making a World of Difference

Jo Nelle Bain '71, '75 has never forgotten the thrill of a 7,000-mile adventure she took at age 10 with her mother. Since then, she has traveled to more than 40 countries and is still finding new places to explore.

Read More

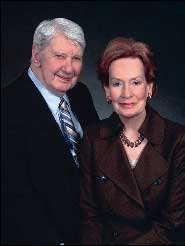

John and Martha Hardt

As lifelong Methodists, Bishop John and Martha Hardt learned early of the importance of financial support for the institutions they loved.

Read More

Jeff Light, SMU '84

Born and raised in Schenectady, NY, Jeff Light chose SMU because he wanted a smaller school away from the Northeast and because a family friend was already attending the university.

Read More

Honoring a Man and a Family

When Gordon Worsham wanted to honor his friend, Bassett Kilgore, he thought of SMU. Basset Kilgore's grandfather, James Kilgore, was a member of the commission that voted to establish SMU in Dallas and with that vote the Kilgore tradition at SMU began.

Read More

With Gratitude

When Patricia Center Radcliffe was born, her parents knew they would like their daughter to attend SMU. In fact, when she was only 11 days old, Patricia's father took out an insurance policy that would expire on her 18th birthday. The intent was to use the money to send Patricia to SMU, a true reflection of Douglas Center's values and belief in the importance of education.

Read More

It's All About Giving Back

When we asked Mary Ann and Ed Hyde '49 why they were inspired to establish four gift annuities at Southern Methodist University, we expected to hear about tax deductions and great payment rates.

Read More

Lamar Jordan Supports the Mustangs On the Field and Off

If you attend a basketball or football game at SMU, you are likely to see Lamar Jordan supporting the Mustangs. Lamar, an Alabama native, was an athlete at Georgia Tech University along with his brothers. After graduating and serving in the military, he settled his young family in Dallas in 1957, building a new business related to the construction industry.

Read More

Grateful Remembrance

It was 1949 when Joel Rubel met his future wife Sylvia in Austin, Texas. After graduating, Joel moved to Dallas where he and Sylvia were married and Sylvia attended SMU.

Read More

Returning the Favor

Sam Thomas is grateful for his Southern Methodist University experience. As a student who benefited from scholarship support at SMU, he wants to help the next generation of SMU students have the same opportunity for success.

Read More

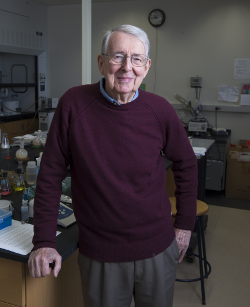

An Instrumental Decision

Milton Bludworth, 95, grew up in a musical family and pursued his interest in music as a member of the Mustang Band. Seven decades later, fond memories of playing in the clarinet section motivated him to include SMU's band in his will.

Read More

Honoring Family by Helping Students

Thanks to the financial assistance of family members, Leo Favrot was able to complete his legal education. When Leo and his wife, Vicky, decided to pay tribute to that kindness, they turned to Southern Methodist University to create a scholarship and an artful legacy.

Read More

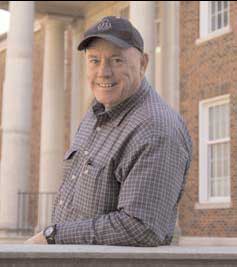

Finding a Plan with the Right Chemistry

SMU Professor Ed Biehl was an aspiring professional pianist when undergraduate science courses changed his life. Opportunities to engage in research sparked a love of chemistry that has inspired him to set the stage for similar discoveries by future SMU students.

Read More

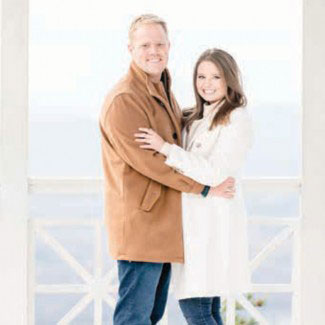

Next Generation Entrepreneurs Plan Ahead

Tech entrepreneurs Tye and Courtney ’00 Caldwell move at a lightning pace. The dynamic couple propelled ShearShare, their mobile app that connects salon and barbershop owners to individual stylists looking to lease professional space by the day, into an international platform in a matter of months.

Read More